How to change from a Sole Trader to a Limited Company

Tax imbalances and disparities in financial security, as well as variations in the amount of taxes paid, can exist among different business structures. Owning a limited company offers the advantage of being able to claim tax relief based on your business expenses. In the UK, there are approximately 3.1 million sole proprietorships, which make up 56% of the total private sector business population. However, transitioning from sole trader to limited company can be challenging, especially when it comes to navigating Companies House, the official website for maintaining company records in the UK, and understanding the associated terminology. Many entrepreneurs and freelancers initially start as sole traders due to factors such as limited working capital and gaining market understanding, among others.

What is a sole trader?

A sole trader is owned and controlled by a self-employed individual and is viewed as a single entity under the law. This legal status entails unlimited personal liability, meaning that the individual is personally responsible for all business debts, losses, and legal claims. Consequently, personal assets and finances, including one’s home, are at risk. If the business experiences financial losses, the likelihood of personal bankruptcy increases. It’s important to note that there is no legal differentiation between a sole trader and their business; they are treated as one and the same.

What is a limited company?

Owned by one or more shareholders and managed by one or more directors, a limited company provides the option to have both ownership and control of the business. A limited company possesses its own distinct identity and assumes responsibility for its own debts and losses incurred in the course of business. As a result, company owners benefit from limited liability, meaning that even if they have contributed their personal finances and assets, they are not held accountable for the company’s bills if it is unable to generate sufficient revenue.

What are the benefits of changing from a sole trader to limited company?

1) Limited Liability: The protection from limited liability is one of the main advantages. All of the debts and liabilities of the business fall under your personal responsibility as a sole proprietor. You can keep your personal assets apart from the business’s finances by functioning as a limited company, nevertheless. As a result, your personal assets are protected and your liability is constrained to the amount you invested in the business.

2) Tax Efficiency: Compared to sole traders, limited firms frequently have more tax planning choices and may be more tax-efficient. As a limited company, you are eligible for a number of tax benefits and exemptions, including the ability to deduct business expenses, adjust losses against profits, and benefit from lower tax rates. This might lead to reduced overall tax obligations and higher take-home pay.

3) Professional Image and Credibility: Being a limited company can improve your credibility and professional image in the eyes of customers, suppliers, and business partners. It gives the impression that the company is more established and serious, which might improve trust and create growth chances.

4) Easier Access to Finance: Compared to sole proprietors, limited businesses typically have more finance choices available. Limited corporations are frequently seen by banks and lenders as being less hazardous and more dependable, making it simpler to get loans, credit facilities, and investment capital. A limited company also makes it possible to raise capital or issue shares.

5) Continuity and Scalability: A limited company, as opposed to a sole proprietorship, can continue to exist even if its owner or board of directors changes. This makes it possible for more consistency and stability, promoting long-term planning and corporate expansion. To raise money and encourage expansion, limited corporations can also issue new shares and recruit new shareholders.

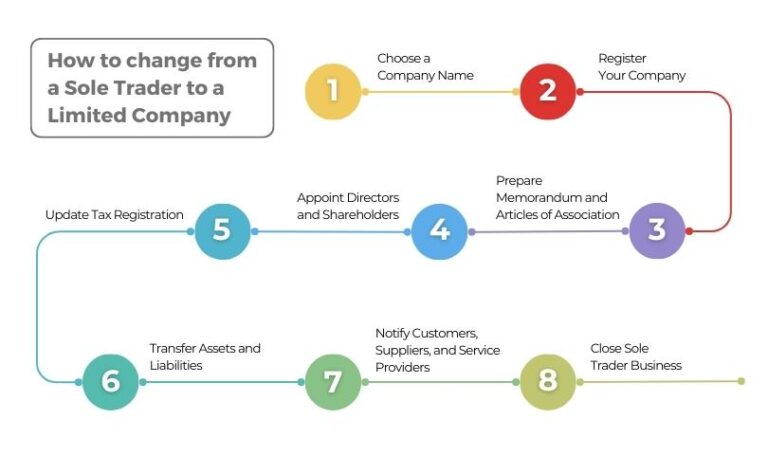

How to change from sole trader to limited company

1) Choose a Company Name: Choose a distinctive name for your limited company that complies with Companies House’s naming guidelines. To find out if your desired name is available, use their online service.

2) Register Your Company: Your limited company must be registered with Companies House. You can do this by mailing the required forms in or by completing them online through the Companies House website. The IN01 form, which contains details on the company’s directors, shareholders, and registered address, is the primary document needed.

3) Prepare Memorandum and Articles of Association: Create the articles of association and memorandum, which set forth the corporate charter and internal governance principles. The rights and obligations of the company’s shareholders and directors are laid out in these documents.

4) Appoint Directors and Shareholders: Determine the people who will represent the limited company’s shareholders and directors. The shareholders will own the company’s shares, but the directors will be in charge of running the business.

5) Update Tax Registration: Notify HMRC (HM Revenue and Customs) of the modification to your company’s structure. Depending on your business activity, you may also need to register your limited company for other taxes in addition to Corporation Tax.

6) Transfer Assets and Liabilities: Transfer your sole proprietorship’s assets and liabilities to the limited company. This can entail changing agreements, licenses, and contracts to reflect the new company’s name.

7) Notify Customers, Suppliers, and Service Providers: Inform your clients, vendors, and service providers about the restructuring of your company. Invoices, contracts, and letterhead should all be updated to reflect the new firm information.

8) Close Sole Trader Business: If you decide you no longer want to be a sole proprietor, you must notify HMRC of your decision and fulfil all applicable tax filing and obligation requirements.

Conclusion:

Taking the leap from being sole trader to limited company requires courage and often necessitates finding a business partner who shares the same goals. This transition is often driven by the vision of expanding the business and reaching new heights. It is imperative in today’s business world to recognize the possibilities of growth and take decisions accordingly to have a prosperous future for your business.